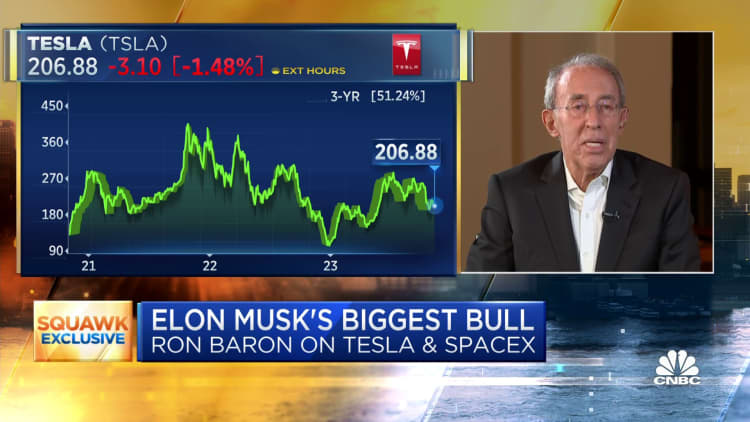

Ron Baron, founder of Baron Capital.

Anjali Sundaram | CNBC

More and more, we are becoming a transactional, impulse-driven society.

With most of our lives tethered to our smartphones and computers, providing endless means of distraction, people’s attention spans have shrunk considerably.

On top of that, businesses have made it much easier to act on our impulses.

Purchases — from as minor as a cup of coffee or a movie ticket to as major as a car or even millions of dollars in bitcoin – are just a swipe or click away.

So what is lost in a world ruled by impulses? We think a lot.

Take the markets, for example.

This year’s dramatic collapse of regional bank Silicon Valley Bank – and several others — happened in large part because of the ability of investors to pull their money within seconds simply by tapping their smartphones.

Would these banks have failed regardless? Impossible to say.

But certainly, the run on these banks was driven entirely by panicked investors afraid of being left holding a bag of worthless assets, and not by a rational, well-thought-out analysis of the circumstances.

We came very close to a full-blown banking crisis because of impulse-driven decision making.

Taking the long view

In this brave new world of instant gratification and transactional relationships, what we do at Baron Capital may seem old-fashioned but we make no excuses. We own what we do. We look for high-conviction growth opportunities in which we can remain invested over the long term.

To build that high level of conviction, we focus on fundamentals: the competitive advantages and exceptional executives of high character we believe are key to a company’s long-term success.

Our deep research bench is the foundation of our investment process: what we like to call “actual intelligence,” not “artificial intelligence.”

Algorithms cannot imagine the future, or evaluate character, talent, and vision.

Nor, for that matter, can an algorithm analyze and weigh the qualitative attributes of a company and its leaders to decide whether it would make a good investment.

We leverage our proprietary research to build a portfolio designed to outperform its benchmark over the long term (although, of course, there are no guarantees). And while we may hold a position for many years, we are hardly passive buy-and-hold investors.

I personally “interview” executives of the companies in which we are invested at least once a day and often more than that. In addition to regular meetings with management, we visit factories and headquarters, speak with competitors, customers, suppliers, and industry experts, and read everything we can get our hands on.

Importantly, we do not ever base our investment decisions on the opinions of others. And our investment horizon is long … ideally, forever.

Staying the course

As growth managers, we believe a long-term investment horizon is key to achieving above-average performance. Sometimes, we follow a company for years before we decide to initiate a position.

Once we’re invested, we will stay invested as long as our thesis remains intact.

We have held shares in Charles Schwab – our longest currently held position – for more than three decades. We first bought shares at less than a dollar each, meaning our current stake is almost 100% profit.

The hardest part of what we do is knowing when not to sell.

It may sound easy – all you have to do is nothing – but it is not. Emotions get in the way. You naturally question yourself. Staying the course during bad times – whether it’s a missed quarterly earnings report or a full-fledged bear market – and not panicking or letting emotions take over requires incredible conviction.

We are able to remove emotions from our calculus because of our ownership mentality.

Just like a CEO doesn’t walk away because of a disappointing quarter, we don’t walk away from our investments. This strategy is key to successful investing.

Emotions are why many nonprofessional (and sometimes professional) investors buy high and sell low.

As big down days are often closely followed by big up days, those who panic and sell on the down days are likely to miss out on the ensuing up days.

We also own our mistakes.

While it can take years before we decide to invest, when we determine that our investment premise is wrong, or growth prospects are no longer favorable, we will sell immediately. And mistakes, while we do not like to make them, are unavoidable in this business.

If investors are afraid to make any mistakes at all, it ultimately limits their opportunities for success. The key is to learn from our mistakes, so we always do a post-mortem to see what we may have missed or went wrong.

Ownership mentality

So, while there is nothing wrong with making the occasional mistake, when we do, we always want to make new ones.

We look for the same ownership mentality in the leaders of our investments.

We favor executives who are as personally invested in the success of their companies as we are.

Elon Musk, CEO and founder of Tesla and Space Exploration Technologies, or SpaceX, is well known for having spent many nights sleeping on the factory floor under his desk.

Bernard Arnault, CEO and founder of the French luxury goods conglomerate LVMH Moet Hennessy Louis Vuitton, had his five children – and now his grandchildren — accompany him on store inspections since they were in elementary school. All four children now work at the company.

Jeff Bezos, CEO and founder of Amazon.com, grinded away for close to a decade before the company turned a profit in 2001 – a measly $5 million.

These are just three examples of the many executives who share our ownership mentality – and in which we invest.

Finally, I would like to point out that I take the same approach to my own business.

I’ve spent my entire career studying, researching, investing in, and “not selling” great businesses.

Baron Capital has been shaped by what I have learned.

Just like businesses we find attractive, we consistently invest in our 45-member research team and more than 200 employees firm-wide, whether times are good or uncertain, like now. We have never had a layoff, and many of our employees have spent most of their career at Baron Capital.

The vast majority of our employees – including all of our portfolio managers — have investments in our funds, many of them significant.

We believe in our investment process and our firm. We own it.

—Ron Baron is the CEO of Baron Capital.

Sumber: www.cnbc.com